Trading support

TS-Energy has a variety of applications in the area of energy trading. The software provides you with pricing and risk analysis for a broad spectrum of energy contracts. Additionally, for virtual power plants and ancillary services optimal prices are calculated.

Front Office

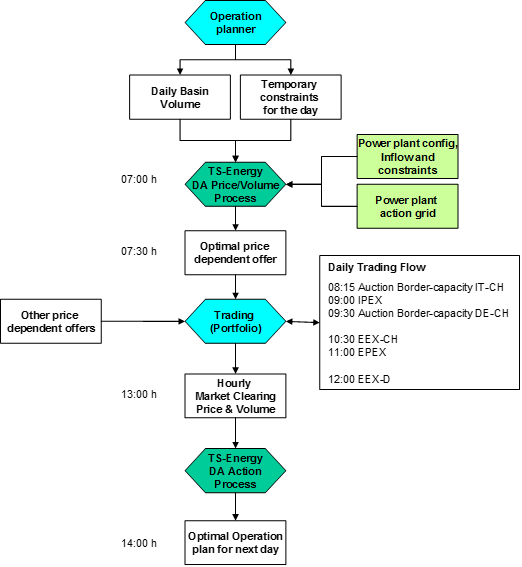

Based on its stochastic dynamic programming, TS-Energy generates hourly margin prices for the intra-day and day-ahead trading. These calculations happen based on input data such as fill levels, inflow projections and possible restraints. The margin prices derived are the minimal price at which electricity should be traded for profitability. It has been shown that this approach leads to significantly better results than other bid-generation methods.

TS-Energy as part of the day-ahead trading flow. It generates optimal price-dependent offers and optimizes the production of the agreed upon amount of energy.

Middle Office

The participation in the ancillary services market can be a profitable supplement to marketing your flexibilities on the day-ahead market. TS-Energy allows a comprehensive valuation of ancillary service contracts and a precise determination of the opportunity costs. Because of that, TS-Energy enables an improved bid generation and a significant profit increases.

Back Office

TS-Energy also generates valuations and risk analysis of your energy portfolios. Additionally TS‑Energy is capable of providing the optimal allocation of any set of hedging instruments based on a selectable criterion such as securing production, securing value or minimizing value at risk.

The calculations can be provided on a daily basis (even for larger power plant complexes) in order to provide the necessary decision-making basis for the trading.